5StarsStocks NVIDIA Stock: NVIDIA has established itself as a powerhouse in the tech world, with substantial influence in sectors like gaming, artificial intelligence, data centers, and more. With such a strong track record, many investors are wondering if NVIDIA can continue its impressive performance in the coming years. This article examines NVIDIA’s strengths, potential challenges, and expert predictions to help investors make informed decisions about the future of NVIDIA stock.

5StarsStocks NVIDIA Stock: The Foundation of NVIDIA’s Success-A Quick Overview

NVIDIA’s success story began in the 1990s with its innovative graphics processing units (GPUs), revolutionizing visual computing. Today, NVIDIA’s reach goes beyond GPUs for gaming; it plays a critical role in AI, autonomous vehicles, data centers, and cryptocurrency mining. This diversified portfolio has enabled NVIDIA to maintain a strong presence in tech, giving it resilience and growth potential that has attracted investors worldwide.

5StarsStocks NVIDIA Stock: How AI and Data Centers Drive NVIDIA’s Growth

The exponential growth in artificial intelligence has created substantial demand for powerful computing capabilities. NVIDIA’s GPUs are the backbone of many AI applications, from deep learning to machine learning models. Moreover, the company’s data center revenue has surged as its GPUs are crucial for processing the vast amounts of data required in cloud computing. This AI and data center focus is expected to continue as NVIDIA builds on its technological edge, reinforcing its growth trajectory.

NVIDIA’s Dominance in the Gaming Sector

While NVIDIA has diversified its business, gaming remains one of its core sectors. The company’s GeForce GPU line is immensely popular among gamers, and its regular hardware upgrades ensure it stays ahead of competitors like AMD. The gaming industry’s growth, especially in areas like eSports and VR, suggests a promising future for NVIDIA’s gaming segment, though competition could bring shifts that investors should keep an eye on.

Autonomous Vehicles: A New Frontier for NVIDIA

Autonomous vehicles (AV) represent one of the most significant advancements in technology, and NVIDIA is leading the way with its DRIVE platform. This platform provides the computational power needed for autonomous driving, making NVIDIA a critical player in the AV space. As the demand for AV technology grows, NVIDIA is well-positioned to benefit. However, regulatory challenges and market adoption rates could influence the speed of this growth.

Cryptocurrency and Blockchain Impact on NVIDIA Stock

Cryptocurrency mining has driven demand for NVIDIA’s GPUs in recent years, contributing significantly to the company’s revenue. However, cryptocurrency markets are highly volatile, and changes in demand or regulatory conditions could affect this revenue stream. While NVIDIA has been proactive in separating its gaming GPUs from its mining-focused models, the company remains partially exposed to crypto’s unpredictability, making this factor worth monitoring.

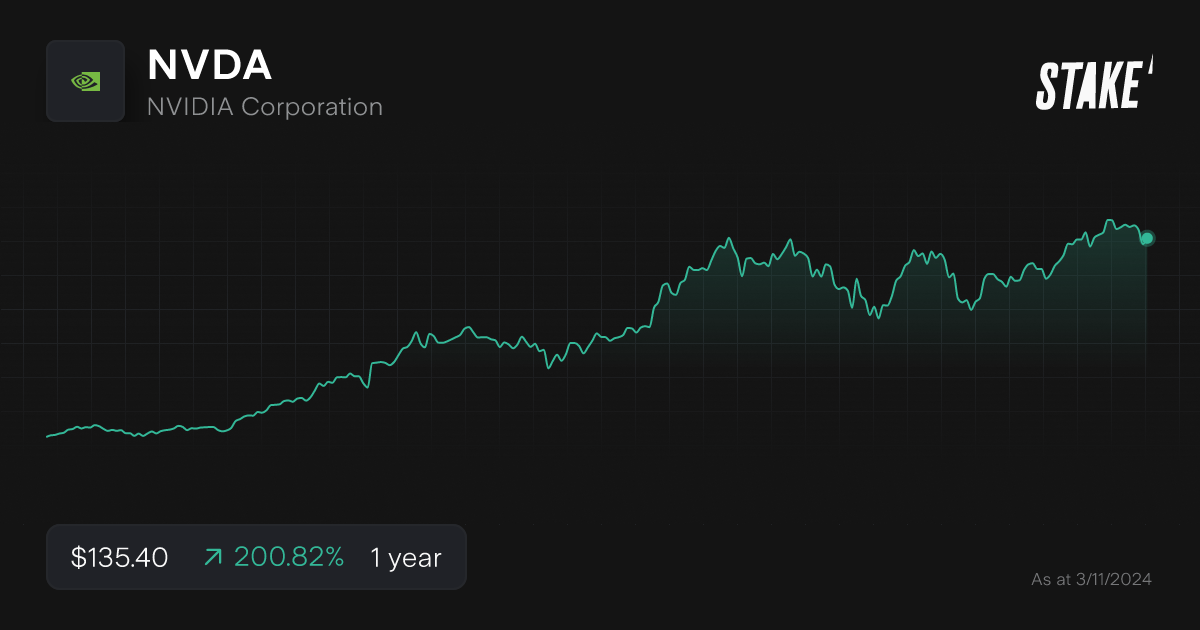

Financial Health and Stock Performance Metrics

A critical factor in understanding NVIDIA’s future potential is its financial health. Key metrics, including revenue growth, profit margins, and R&D spending, demonstrate that NVIDIA is on solid ground. Its focus on innovation through R&D has propelled the company forward, allowing it to retain its competitive edge. Monitoring these financial indicators can help investors gauge NVIDIA’s ability to withstand challenges and capitalize on new opportunities.

Analyzing NVIDIA’s Competitors and Market Position

NVIDIA faces fierce competition from companies like AMD, Intel, and newcomers in the AI chip market. Each competitor presents unique challenges and strengths that could impact NVIDIA’s market share. NVIDIA’s superior AI capabilities give it a significant edge, but investors should consider how competitive developments might influence NVIDIA’s future. By comparing financials, innovation, and strategic moves of its competitors, investors can better understand NVIDIA’s potential market position.

Key Predictions for NVIDIA’s Stock Performance

Industry analysts generally hold a positive outlook for NVIDIA, with some predicting continued growth as the company expands into new markets. AI and data centers are expected to remain robust drivers, while autonomous vehicles could bring additional growth in the long term. While analysts anticipate stock appreciation, potential risks like regulatory changes, global supply chain issues, and competition could affect these predictions.

Risks and Challenges That Could Affect NVIDIA’s Stock

Despite NVIDIA’s impressive growth, it faces certain risks. One significant challenge is the global semiconductor supply chain, which could impact NVIDIA’s production capabilities. Regulatory risks also loom large, particularly with regard to international trade restrictions and environmental regulations. As NVIDIA grows, it must manage these challenges effectively to ensure sustained success and mitigate negative impacts on its stock performance.

Investor Sentiment and Market Trends in 2024

Investor sentiment can heavily influence NVIDIA’s stock trajectory. As of now, NVIDIA enjoys a strong reputation in the investment community, driven by its consistent performance and innovative portfolio. However, broader market trends, such as tech stock rotations or economic downturns, could affect sentiment and introduce volatility. By staying informed on overall market conditions and industry trends, investors can better assess the potential impact on NVIDIA stock.

Conclusion

5StarsStocks NVIDIA Stock: NVIDIA’s track record and innovative portfolio position it as a compelling investment for tech-focused investors. With substantial growth drivers in AI, data centers, gaming, and autonomous vehicles, NVIDIA is well-positioned to continue outperforming. However, as with any investment, there are risks to consider, including competition, regulatory challenges, and market volatility. By keeping an eye on NVIDIA’s key metrics, industry trends, and competitor developments, investors can make informed decisions on whether NVIDIA stock will continue to be a winner in the tech space.

FAQs

1. Can NVIDIA continue to grow in the AI market?

Yes, NVIDIA has a strong foothold in AI, and as demand for AI applications grows, NVIDIA’s technology will likely remain in high demand, driving further growth.

2. Is NVIDIA a good stock for long-term investment?

Many experts consider NVIDIA a strong long-term investment due to its diversified portfolio in AI, gaming, and data centers. However, investors should stay aware of industry shifts and potential risks.

3. How does cryptocurrency impact NVIDIA’s stock?

Cryptocurrency mining has increased demand for NVIDIA’s GPUs. However, crypto market volatility can lead to fluctuations in demand, which could impact NVIDIA’s revenue.

4. What are the main risks facing NVIDIA’s stock?

NVIDIA’s main risks include competition, regulatory challenges, supply chain issues, and potential market volatility. Monitoring these factors can help investors manage these risks.

5. How can investors predict NVIDIA’s future performance?

Investors can track NVIDIA’s earnings, monitor industry trends, follow competitor actions, and analyze financial health metrics for a clearer view of its future performance.

Also read: Pellets for Pellet Stove: 10 Advantages of Using Quality Fuel for Your Home