Imagine this: You’re cruising down I-25, vibing to your favorite tunes, life’s sweet in Mile-High City. Suddenly, out of the blue, a wild Prius appears, and boom! You’re in for a fender bender escapade. Welcome to the exhilarating realm of car accidents in Denver. But hold off on the sympathy for your banged-up car. You need to dig into Colorado’s fault laws, and let me tell you, it’s as clear-cut as navigating a mountain switchback. Check out the source for more information.

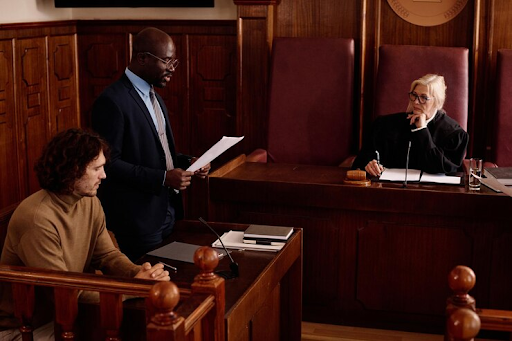

So, here’s the scoop: Colorado plays by the “at-fault” rules. That means if your joyride turns into bumper cars, the person who did the oopsie pays the piper. But determining who’s the maestro of the mishap isn’t like declaring the winner of a chili cookoff – it’s complex! This is where a savvy Colorado car accident lawyer can slide into your DMs like an angel in a business suit. They’ve got the playbook on how to navigate the legal mosh pit post-collision.

Whether you’re the innocent bystander or the not-so-proud recipient of a traffic boo-boo, knowing the dance steps of at-fault laws is your ticket to tango. From counting the beats until you file a claim, to tapping your toes through Colorado’s insurance choreography, a Denver car accident lawyer will lead you in this legal line dance. So, buckle up, buttercup. It’s time to learn the rights like it’s the last call at the LoDo bar – just hopefully with less stumbling.

Diving Into Colorado’s Fault System

Getting caught up in a Colorado car accident tangle? Strap in, because you’re about to navigate the rockies of legal lingo and time-sensitive statutes. Bonus: no necktie or gavel required.

Understanding Fault vs. No-Fault States

Fun fact: Colorado traded in its no-fault status for an at-fault membership card back in 2003. What does this mean for you? In a no-fault state, your insurance company pays for your damages, no matter who caused the accident. However, Colorado prefers pointing fingers with its at-fault system. If you’re unfortunately crunched in a car calamity, you’ll aim your claims at the insurer of the person who wink wink “allegedly” played bumper cars with your ride.

Colorado’s Modified Comparative Negligence Explained

Now, it’s not all about the blame game. Colorado has a heart and follows the “modified comparative negligence” rule. It’s like getting a piece of the pie unless you’re more than 49% at fault, then no pie for you! Simply put, if you’re less than 50% responsible for the crash, you can still recover damages but reduced by your slice of the fault. Imagine you’re awarded $10,000 and you’re 30% at fault, you’ll walk away with $7,000 instead of the full amount. Fair’s fair, right?

Statutes of Limitations: Racing Against the Clock

Tick-tock, the clock doesn’t stop. In Colorado, you’ve got three years from the crash date to bring up injury or property damage claims according to Colorado Revised Statutes 13-80-101. Miss this timeline, and you may as well wave goodbye to your chance at compensation. So, mark your calendar and get your pedal to the legal metal; time is of the essence!

The Ins and Outs of a Car Accident Claim

Buckle up! You’re about to navigate the bumpy road of car accident claims in Colorado. Get ready to master the art of dealing with insurance companies, understanding the potential value of your bumper, and taking the right steps post-collision.

First Steps After a Crash: The Claim Saga Begins

Picture this: you’ve just been in a fender bender. What’s next? Before you even think about saying “I’m fine,” grab your phone. Dialing the police should be your opening move; this isn’t just about the law, it’s about getting an official report. This document will be your golden ticket when dealing with insurance companies. Next, transform into a detective – it’s picture-taking time! Photograph everything: the damages, the road warrior who bumped into you, and the surrounding scene, ensuring you have all the evidence you need.

Navigating Through the Insurance Maze

Now the real fun begins. Contact your insurance provider and file a claim. This isn’t just a friendly chat; it’s a strategic step, so keep your wits about you. Be detailed but don’t overshare – think of it as a first date. You’ll need your insurance policy number, the details of the incident, and your trusty photos. Oh, and remember, just like in a rom-com, good faith goes both ways with insurance companies. So, no fibbing about how your bumper had a previous encounter with a rogue shopping cart.

- Contact your insurance provider

- Provide the policy number & details of the crash

- Submit photos and police report

Calculating Damages: The Value of a Bumper

When it comes to damages, not all bumpers are created equal. Your bumper’s value is like a treasure chest that’s calculated by combining economic damages, like medical bills, with non-economic damages, such as pain and suffering from missing your Saturday yoga class because you can’t twist like a pretzel anymore. If you’ve got collision coverage, you might be in luck for a repair or replacement. Remember to keep a running tally of all costs. This could range from personal injury rehab sessions to the number of days you took the bus because your ride was out of action.

| Type of Damage | Examples |

| Economic | Medical bills, Car repairs |

| Non-Economic | Pain and suffering, Stress |

Get in touch with a savvy Denver car accident lawyer to navigate the tortuous routes of tort law and liability coverage. Whether it’s a settlement sprint or a trial marathon, they’ll help keep your feet on the ground and your settlement soaring.

Hiring a Car Accident Attorney in Denver: A Wise Crack or a Smart Move?

Let’s face it, nobody plans to be in a fender bender during their morning latte run. But when you find yourself playing bumper cars on the way to work, you’re left with a real headache—and I’m not just talking about the caffeine withdrawal.

Navigating Denver’s Streets and Laws: Denver’s roads are as complex as its weather patterns. When you’re the victim of a rear-end collision, who’s at fault? The guy tailgating you or the sudden blizzard? That’s where your Denver car accident attorney swoops in – not with a cape, I might add, but with a sharp mind for insurance tangles and fault lines.

The Lowdown on Legalese: Picture this: you’re handed a stack of legalese thicker than your car’s owner’s manual. An attorney helps you make sense of terms like “negligence” without making you feel, well, negligent. They comb through witness statements and get your story straight.

Conclusion

So, you’ve twisted through the maze of Colorado’s at-fault car accident laws and you’re almost at the finish line. Remember, time waits for no one, and neither does the Statute of Limitations in Colorado. Mark your calendar for a three-year countdown because that’s your time frame to launch a claim for those fender benders (or worse).

Getting into an accident in Colorado means you’ve got to put on your detective hat. It’s all about proving who’s to blame. And since it’s not always as clear as the difference between your morning coffee and orange juice, this is where a savvy Denver car accident lawyer can be your “caffeine” – waking up your case and energizing your claim!

- Insurance Tango – Dance carefully; you claim against the at-fault party’s insurance.

- Prove It! – If you’re pointing fingers, make sure you’ve got the evidence to back it up.

- Legal Buddy – Hiring a Denver car accident lawyer might just be the best partnership you dance into.

And hey, if someone tries to tell you that you can file with your own insurance no matter what, just give them the “not in Colorado” talk. It’s like trying to order a New York-style pizza in the mile-high city—you’ve got to follow the local flavor, and in this case, that means navigating fault laws with finesse.