In today’s fast-paced world, managing finances efficiently is essential for maintaining a balanced lifestyle. With the advent of technology, various tools have emerged to simplify money management, and one such tool is a popular payment app that has gained traction for its user-friendly interface and convenience, making it a favorite among many. In this article, we will explore the Tikkie Advantage by highlighting ten surprising benefits of using it every day.

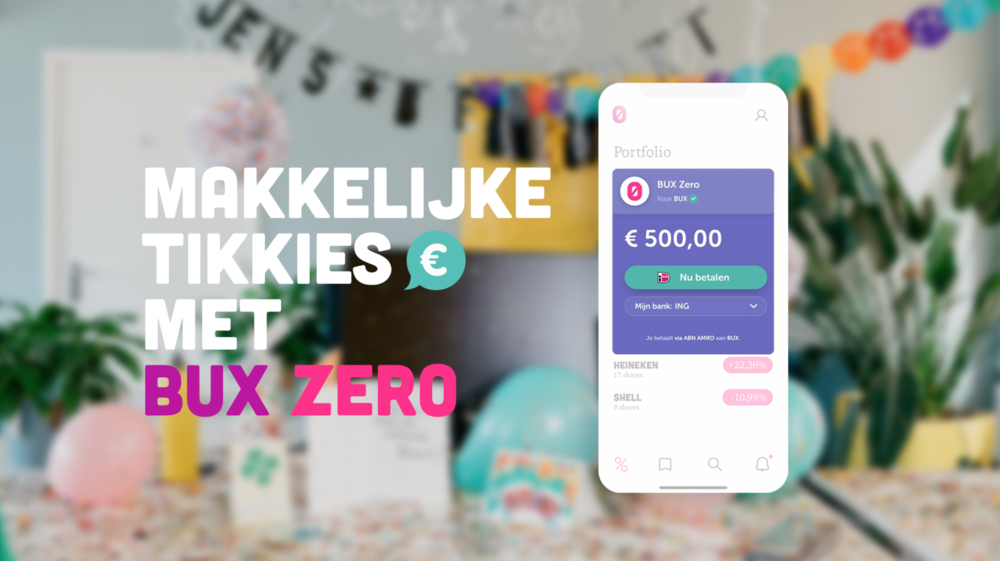

Tikkie Simplifies Split Payments

One of the most significant advantages is its ability to simplify split payments. Whether dining out with friends or sharing costs for a gift, the app allows users to send requests for money quickly. This feature eliminates the awkwardness of asking for cash and streamlines the process, making outings more enjoyable.

Tikkie Offers Instant Transactions

With the app, transactions happen almost instantly. Unlike traditional banking methods that can take time to process, it ensures that money transfers occur in real time. This feature is especially beneficial when you need to settle a bill promptly or share costs with friends during an outing.

Tikkie Enhances Social Interactions

Using the app can enhance social interactions by removing financial barriers. When everyone can easily contribute their share, it fosters a more collaborative atmosphere. Its intuitive design encourages users to engage more freely with friends and family without the stress of handling payments separately.

Tikkie Increases Financial Awareness

Regular use of the app can help increase financial awareness. By tracking daily transactions and split payments, users can better understand their spending habits. This awareness can lead to more informed financial decisions and ultimately improve budgeting skills.

Tikkie Provides Secure Transactions

Security is paramount in financial transactions, and the app takes this seriously. It employs advanced security measures to protect users’ information and transactions. With encrypted systems, users can feel safe while sending or receiving money, which is crucial in today’s digital landscape.

Tikkie Allows Custom Payment Requests

Another remarkable feature is the ability to customize payment requests. Users can tailor their requests by adding descriptions or notes, making it easier for others to understand what the payment is for. This customization reduces confusion and ensures clarity in financial interactions.

Tikkie Supports Various Payment Methods

The app offers flexibility by supporting various payment methods. Users can choose to pay via bank transfers or credit cards, catering to different preferences. This versatility makes it accessible to a broader audience, enhancing its appeal as a daily financial tool.

Tikkie Facilitates Group Expenses

Managing group expenses can be a hassle, but the app simplifies this process significantly. Whether planning a trip or hosting an event, users can create group payment requests, ensuring everyone contributes their fair share. This feature saves time and minimizes disputes regarding who owes what.

Tikkie Promotes Cashless Transactions

In an increasingly cashless society, the app promotes digital transactions, making financial dealings more convenient. By encouraging users to adopt cashless payments, it aligns with modern banking trends and supports eco-friendly practices by reducing the need for physical currency.

Tikkie Is User-Friendly

Finally, the app’s user-friendly interface makes it accessible for everyone, regardless of their tech-savviness. The straightforward design and easy navigation allow users to manage their finances with ease. This simplicity is a significant factor in its growing popularity among various demographics.

Conclusion

The Tikkie Advantage is evident in its many benefits that cater to the modern user’s needs. From simplifying payments and enhancing social interactions to promoting financial awareness and security, it stands out as an invaluable tool in daily life. By adopting the app, users can enjoy a more organized and efficient approach to managing their finances.

FAQs

1. What is the app?

The app is a payment tool that allows users to send and receive money easily and securely. It simplifies transactions among friends and family, making it a popular choice for managing shared expenses.

2. How do I use the app to split bills?

To split bills using the app, simply create a payment request within the app, specify the amount each person owes, and send it to your friends. They can then pay directly through the app.

3. Is the app safe to use?

Yes, the app employs advanced security measures to protect users’ data and transactions, making it a secure option for managing money.

4. Can I use the app for international payments?

Currently, the app primarily supports transactions within specific countries. Check the app for details on supported regions and payment methods.

5. Do I need a bank account to use Tikkie?

Yes, you will need a bank account to set up Tikkie and link it for sending and receiving money. The app facilitates transactions directly through your bank account.

Also read: The Hidden Children of Ruinerwold Farm: 10 Lessons from Their Lives